“SunTrust Online Banking: A Comprehensive Guide

SunTrust Online Banking: A Comprehensive Guide

In today’s fast-paced digital world, online banking has become an indispensable tool for managing personal finances. SunTrust Bank, now a part of Truist, offered a robust online banking platform that provided customers with a convenient and secure way to access their accounts, conduct transactions, and manage their financial lives. While the SunTrust brand is no longer active, understanding its online banking features provides valuable insight into the evolution of digital banking and the services offered by its successor, Truist.

This comprehensive guide explores the key features and functionalities of the former SunTrust Online Banking platform, highlighting its strengths and limitations. We will delve into account access, transaction management, bill pay, customer support, security measures, and mobile banking capabilities. This information serves as a valuable resource for those who previously used SunTrust Online Banking and for those interested in understanding the features of similar online banking platforms.

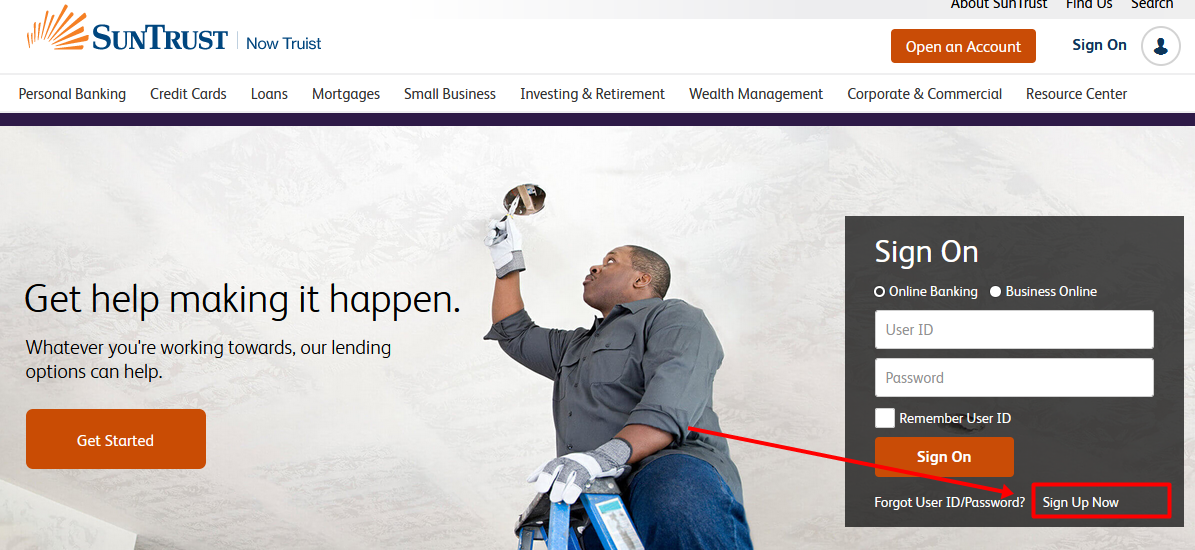

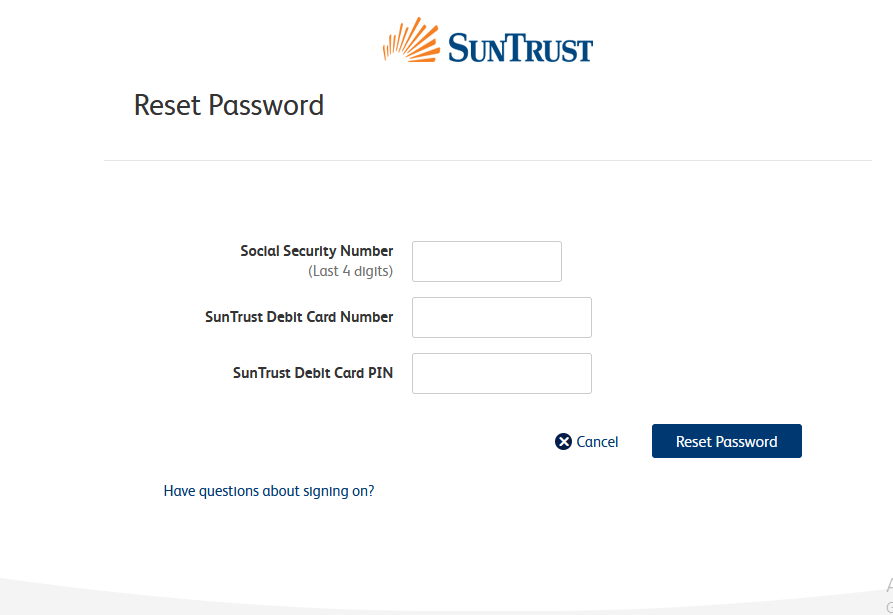

Accessing SunTrust Online Banking

Accessing SunTrust Online Banking was straightforward. Customers needed to visit the SunTrust website and navigate to the online banking login page. Users then entered their user ID and password to access their accounts. For security purposes, SunTrust employed multi-factor authentication, requiring customers to verify their identity through additional means, such as a one-time code sent to their registered mobile phone or email address. This added layer of security significantly reduced the risk of unauthorized access.

Account Management and Transaction History

Once logged in, customers had access to a comprehensive overview of their accounts, including checking, savings, money market, and loan accounts. The platform provided detailed account information, such as account balances, transaction history, and pending transactions. Users could easily view their transaction history, download statements in various formats (PDF, CSV), and search for specific transactions using filters such as date, amount, and payee. This feature was crucial for budgeting, tracking expenses, and reconciling accounts.

Bill Pay and Transfer Capabilities

SunTrust Online Banking offered a convenient bill pay service, allowing customers to pay their bills electronically. Users could add payees, schedule payments for future dates, and view payment history. The platform supported both one-time and recurring payments, offering flexibility for managing various bills. Furthermore, SunTrust Online Banking facilitated seamless transfers between accounts, allowing customers to move funds between their checking, savings, and other linked accounts. This functionality was particularly useful for managing cash flow and allocating funds for different purposes.

Customer Support and Assistance

SunTrust provided various customer support channels to assist users with any questions or issues they encountered while using the online banking platform. Customers could access help through a dedicated online help center, which contained FAQs, tutorials, and troubleshooting guides. Alternatively, they could contact customer support via phone, email, or live chat. SunTrust’s customer service representatives were generally responsive and knowledgeable, providing timely assistance to resolve any issues.

Security Measures and Fraud Prevention

SunTrust prioritized the security of its online banking platform, implementing robust measures to protect customer data and prevent fraud. The platform used advanced encryption technology to secure transactions and protect sensitive information. SunTrust also employed fraud detection systems that monitored account activity for suspicious patterns and alerted customers to potential threats. Furthermore, the bank provided educational resources to help customers identify and avoid common online banking scams.

Mobile Banking App

SunTrust offered a dedicated mobile banking app, compatible with both iOS and Android devices. The app provided users with convenient access to their accounts on the go. The app mirrored many of the functionalities of the online banking platform, allowing users to check balances, view transaction history, transfer funds, pay bills, and deposit checks using their mobile device’s camera. The mobile app’s user-friendly interface and intuitive design made it easy for users to manage their finances from anywhere, at any time.

Strengths of SunTrust Online Banking

SunTrust Online Banking had several notable strengths that contributed to its popularity among customers. The platform was user-friendly, with a clean and intuitive interface that made it easy for users to navigate and access the features they needed. The platform’s robust security measures provided peace of mind to customers, knowing that their financial information was protected. The availability of multiple customer support channels ensured that users could receive timely assistance when needed. Finally, the integration with the mobile banking app provided unparalleled convenience for managing finances on the go.

Limitations of SunTrust Online Banking

Despite its strengths, SunTrust Online Banking had some limitations. While the platform offered a wide range of features, some users might have found the interface slightly dated compared to newer online banking platforms. Furthermore, some users reported occasional technical glitches or slow loading times, which could be frustrating. While SunTrust provided excellent customer support, the wait times could sometimes be longer during peak hours.

Transition to Truist and Future Outlook

With the merger of SunTrust and BB&T to form Truist, the SunTrust Online Banking platform has been integrated into Truist’s digital banking platform. Customers who previously used SunTrust Online Banking were transitioned to the Truist platform, which offers a similar range of features and functionalities with potential enhancements and improvements. The transition aimed to provide customers with a more seamless and integrated banking experience. Truist continues to invest in its digital banking platform, enhancing its features and security measures to meet the evolving needs of its customers. The future of Truist’s online banking platform is likely to focus on further integration of technologies such as artificial intelligence and machine learning to personalize the banking experience and enhance security.

Conclusion

SunTrust Online Banking was a reliable and user-friendly platform that provided customers with convenient access to their accounts and a wide range of financial management tools. While the SunTrust brand is no longer in use, the legacy of its online banking platform continues to shape the digital banking landscape. The features and functionalities offered by SunTrust Online Banking serve as a benchmark for evaluating the capabilities of other online banking platforms. The transition to Truist’s digital banking platform marks a new chapter in the evolution of digital banking, promising enhanced features, improved security, and a more seamless banking experience for customers. The focus on innovation and technological advancements ensures that digital banking continues to adapt to the changing needs of consumers in the ever-evolving financial technology landscape.